👀 WEEKLY SUMMARY 28.10-1.11 / FORECAST

📉 S&P500 - 13th week of the basic cycle (20 weeks on average). The scenario played out exactly as expected; see forecasts from last week (https://t.me/jointradeview/253) and the week before (https://t.me/jointradeview/247). The extreme forecast from October 14 pushed the market down. The weak extreme forecast on October 23 turned the market up slightly but couldn’t hold. The NASDAQ formed a double top at the Algol level (https://t.me/jointradeview/161) and dragged the markets down. The next "scheduled (https://t.me/jointradeview/20)" extreme forecast is on Monday, November 4. It’s likely that the market will focus on closing the gap that the S&P index formed on Thursday.

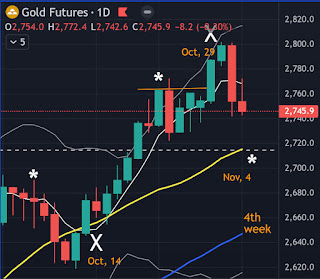

🏆 GOLD - 4th week of the basic cycle (15-20+ weeks). The extreme forecast on October 29 turned the market one day later than expected. I mentioned this correction last week (https://t.me/jointradeview/253). The formation of the first phase of the new cycle is underway. I closed the position from October 14 based on the forecasted extreme. The next "scheduled (https://t.me/jointradeview/15)" extreme forecast is on November 18. Intermediate signals are on November 4 and 11. The potential technical target of the current correction is marked on the chart along with the November 4 signal.

🛢 CRUDE - 22nd week of the basic cycle (28 weeks), 2nd phase. Last week, crude closed the gap that opened on Monday (see chart). Otherwise, the bearish trend I predicted back in June (https://t.me/jointradeview/140) continues. The next extreme forecast is on November 15 (not mentioned at the start of the year). This setup could lead to a supply constraint for crude. It will be the 24th week of the basic cycle, marking a timing for a reversal and the beginning of a new cycle (the previous cycle lasted 25 weeks).

#stocks #gold #crude

Comments

Post a Comment